*Disclaimer: The information provided here is for informational purposes only and does not constitute financial advice. Cryptocurrency trading involves risks, so please DYOR. For beginners, check out our Beginners Guides to learn more.

Trade Republic

Trade Republic: Regulated European Broker for Stocks, Crypto & More

Founded in Berlin in 2015, Trade Republic has rapidly become a major European digital investment platform, distinguishing itself by operating with a full German banking license. Supervised by Germany's BaFin and the Bundesbank, it offers a mobile-first experience focused on democratizing access to capital markets. Trade Republic provides a unified platform where users can invest in commission-free stocks and ETFs (plus a flat fee), derivatives, and also buy, sell, and hold popular cryptocurrencies, all within a regulated banking environment.

Core Offerings: A Unified Investment Platform

Trade Republic's main appeal lies in its integration of various asset classes within a single application:

- Stocks & ETFs: Users can invest in thousands of global stocks and Exchange-Traded Funds (ETFs). Key features include:

- Commission-Free Trading: Trades incur zero commission, with only a small, fixed external settlement fee (typically €1) per transaction.

- Fractional Shares: Allows investing in portions of expensive shares, making blue-chip stocks accessible with small amounts (e.g., starting from €1).

- Savings Plans: Users can set up automated, recurring investment plans (DCA - Dollar-Cost Averaging) for stocks and ETFs, executed free of order commission (the €1 settlement fee still applies).

- Derivatives: Offers trading in certain derivatives like warrants and knock-out certificates, typically via partnerships with established issuers (e.g., Société Générale, HSBC, Citi). Note: Derivatives are complex instruments carrying high risk and are generally suitable only for experienced investors.

- Cryptocurrency Investing: Trade Republic provides access to popular cryptocurrencies within its regulated framework:

- Availability: Users can buy, sell, and hold assets like Bitcoin, Ethereum, and a curated selection of major Altcoins (typically around 50+).

- Pricing: Crypto trades do not follow the €1 flat fee model used for stocks/ETFs. Instead, pricing is spread-based, meaning the cost is included in the difference between the buy and sell price quoted. Users should review the effective price at the time of transaction.

- Custody: Cryptocurrency assets are held custodially on behalf of the user by Trade Republic's regulated partner, BitGo Deutschland GmbH. This means users do not control their own private keys.

- Withdrawals: Crucially, Trade Republic currently does NOT support the transfer of cryptocurrency assets to external wallets. Crypto purchased on the platform can only be held or sold back to fiat currency within the Trade Republic account.

Platform & User Experience

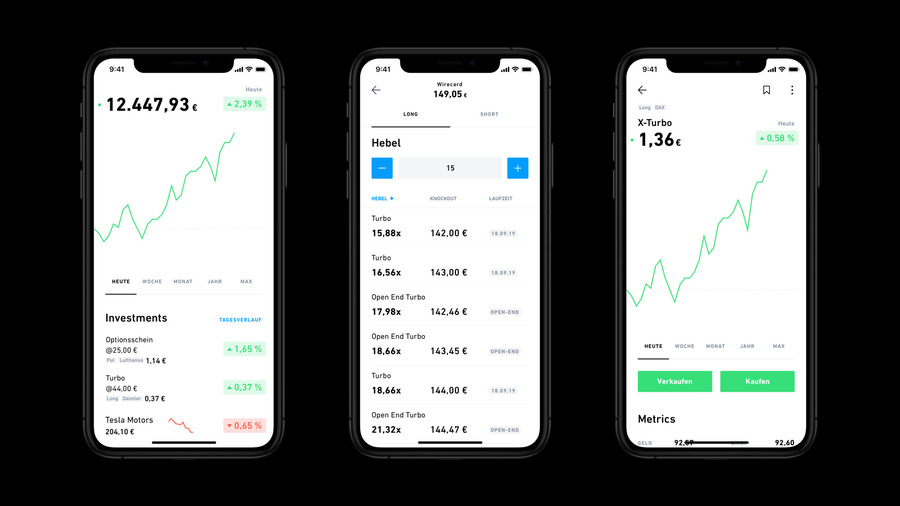

Trade Republic is designed primarily for mobile use with a focus on simplicity:

- Mobile-First App: The core experience is delivered through an intuitive and streamlined mobile application for iOS and Android, designed for easy navigation and order execution. Web access is also available.

- Interest on Cash: Offers users interest (variable rate, check current terms) on uninvested cash balances held in their accounts, often up to a significant threshold (e.g., €50,000).

- Basic Educational Content: Provides market insights and basic financial explainers within the platform.

Regulation and Security

Operating as a licensed bank in Germany provides a strong regulatory foundation:

- Full German Banking License: Trade Republic Bank GmbH is supervised by BaFin (Germany's Federal Financial Supervisory Authority) and the Deutsche Bundesbank. This subjects it to stringent EU and German banking regulations (including MiFID II requirements), offering a high level of oversight compared to many non-bank crypto platforms.

- Investor Protection:

- Cash Deposits: Held in segregated omnibus trust accounts with established partner banks (e.g., Deutsche Bank, JPMorgan SE, Citibank Europe plc, HSBC). These deposits are protected by statutory deposit guarantee schemes (up to €100,000 per investor, per bank).

- Securities: Stocks and ETFs are held in custody with partner banks and remain the legal property of the investor, segregated from Trade Republic's assets.

- Cryptocurrencies: Held custodially by BitGo Deutschland GmbH, a BaFin-licensed crypto custodian, segregated from Trade Republic's corporate assets.

- Account Security: Employs standard security practices including secure login procedures, data encryption, and Two-Factor Authentication (2FA) options. General crypto safety advice is always relevant: How To Store Crypto, How to Avoid Crypto Scams.

Fee Structure Summary

Trade Republic's pricing is a key feature, but differs by asset class:

- Stocks & ETFs: Zero commission per trade. A €1 flat fee applies per transaction for external settlement costs. Savings plan executions are free of the €1 fee.

- Cryptocurrencies: Spread-based pricing. No separate commission is charged, but the cost is embedded within the difference between the buy and sell prices offered on the platform.

- Other Fees: Generally no account maintenance fees. Fees may apply for derivatives trading, specific corporate actions, or optional services. Users should consult the official price and service directory.

Points to Consider Before Using Trade Republic

- Broker, Not a Crypto-Native Exchange: Trade Republic is primarily a securities broker that also offers access to crypto. It lacks the deep order books, advanced charting tools, extensive crypto-specific features (like complex staking, lending protocols, launchpads), or vast altcoin selection found on dedicated crypto exchanges like Binance or Kraken.

- No Crypto Withdrawals to External Wallets: This is a critical limitation. You cannot send crypto purchased on Trade Republic to your own private wallet (like a Ledger or MetaMask) or another exchange. Your crypto exposure is confined to buying, holding, and selling within their platform. This prevents participation in DeFi or self-custody.

- Custodial Crypto Holding: All crypto assets are held custodially via BitGo Germany. Users do not possess their private keys and rely on Trade Republic and its partner for security and access.

- Crypto Trading Costs (Spreads): The effective cost of buying/selling crypto via spreads may be higher than the highly advertised €1 flat fee for stocks/ETFs or the maker/taker fees on dedicated exchanges.

- Limited Crypto Selection: Offers major cryptocurrencies and popular altcoins, but the selection is significantly smaller than on large global crypto exchanges.

- Geographic Focus: Primarily available to residents within the European Economic Area. Check availability for your specific country.

- Market Risks: All investments, including crypto, involve risk and are subject to market Crypto Volatility.

Conclusion

Trade Republic offers a compelling proposition for European investors seeking a simple, regulated, mobile-first platform to manage a diverse portfolio of traditional assets (stocks, ETFs) and popular cryptocurrencies in one place. Its status as a fully licensed German bank provides a strong layer of regulatory assurance, and its low-cost model for stock and ETF investing is highly attractive.

However, when considering its cryptocurrency offering, potential users must understand its key limitations: it operates as a broker with custodial holding via BitGo, employs spread-based pricing for crypto trades, and most importantly, does not allow the withdrawal of cryptocurrencies to external wallets. This makes it unsuitable for users prioritizing self-custody or wanting to use their crypto within the broader DeFi ecosystem. For investors comfortable with these constraints and valuing regulatory oversight and a unified multi-asset experience, Trade Republic presents a streamlined and secure option within the European market.

Explore other platforms on our Exchanges page or learn more about exchanges and brokers in general in our guide: Understanding Crypto Exchanges.